The Best Strategy To Use For Medicare Advantage Agent

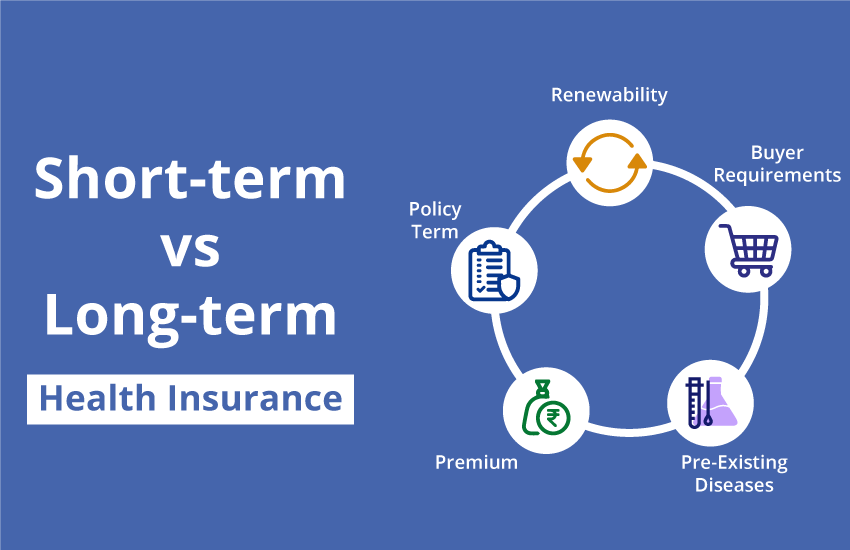

insurance insurance policy on access accessibility health wellness is well established. For still others, wellness insurance coverage alone does not make sure receipt of care since of other nonfinancial obstacles, such as a lack of wellness care carriers in their area, limited accessibility to transport, illiteracy, or linguistic and cultural distinctions. An adjustment in insurance premium or terms, as well as adjustments in earnings, health and wellness, marriage condition, terms of work, or public policies, can cause a loss or gain of wellness insurance policy protection.

The government pays more than it must for these strategies, while the included business make a larger revenue. This game includes business paying doctors to report more wellness troubles, sharing the extra money with physicians, and also owning the physician's workplaces.

Wellness treatment protection helps you get the care you require and shields you and your household financially if you obtain unwell or hurt. View: Are you all of a sudden needing health insurance? All wellness intends need you to

pay some of the cost of expense health care.

Medicare Advantage Agent Fundamentals Explained

The federal government pays greater than it needs to for these plans, while the included business make a larger profit. This game consists of business paying doctors to report more health issue, sharing the additional money with physicians, and also owning the physician's workplaces. Getting ill can be pricey. Even minor diseases and injuries can set you back hundreds of dollars to diagnose and treat.

Major diseases can set you back lot of times that. Wellness care coverage helps you get the care you need and secures you and your family economically if you obtain unwell or injured. You can obtain it with: Your job or your spouse's work, if the company uses it. You need to satisfy eligibility needs for federal government healthcare programs. For even more details concerning government programs, browse through Benefits.gov. informative post Discover more: Wellness insurance coverage: 5 points you might not understand See: Are you instantly requiring medical insurance? You can add your family members to a job health insurance plan. If you get from an insurance firm or the industry, you can purchase

divorced, having a baby, or adopting a kid. You can register for a work health insurance plan when you're first employed or have a major life modification. They can not reject you coverage or cost you more as a result of a preexisting problem or handicap. The expense depends upon your situations. You'll need to pay costs and part of the expense of your treatment. A costs is a monthly charge you pay to have insurance coverage. To determine your premium, insurer will certainly think about: Your age. Whether you smoke or utilize cigarette. Whether the insurance coverage is for a single person or a family. They might not consider your gender or wellness aspects, including your case history or whether you have a handicap. Costs for private strategies are secured in for one year. Fees generally go up when the strategy is restored to reflect your age and higher health and wellness care expenses. All health insurance plan need you to.

The Single Strategy To Use For Medicare Advantage Agent

pay some of the cost of your healthcare. This is called cost-sharing. In addition to premiums, you normally have to meet a deductible and pay copayments and coinsurance. A is the amount you have to pay before your plan will certainly pay. If your insurance deductible is$ 1,000, your plan won't pay anything up until you've paid $1,000 on your own.

The federal government pays more than it important link should for these strategies, while the included firms make a larger profit. This video game consists of business paying physicians to report more wellness troubles, sharing the additional money with physicians, and even owning the medical professional's workplaces.

Not known Incorrect Statements About Medicare Advantage Agent

Wellness treatment insurance coverage assists you get the treatment you require and shields you and your family members economically if you get unwell or injured. See: Are you all of a sudden needing health insurance? All wellness intends require you to.

Medicare Advantage Agent Fundamentals Explained

pay some of the cost of expense health careWellness

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)